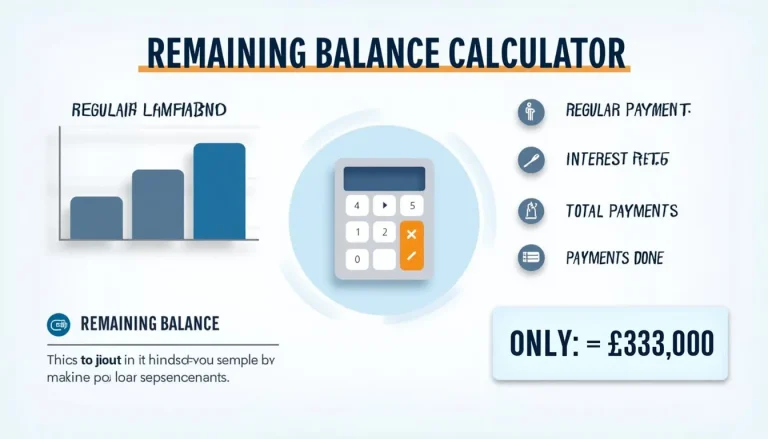

Remaining Balance Calculator: Easily Track Your Loan Payoff Progress

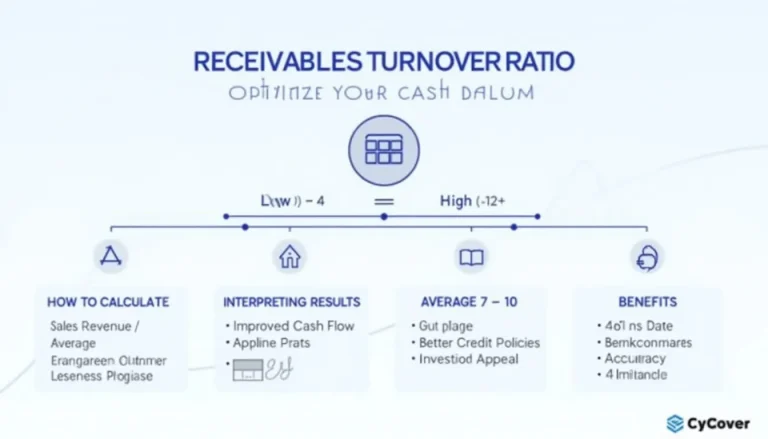

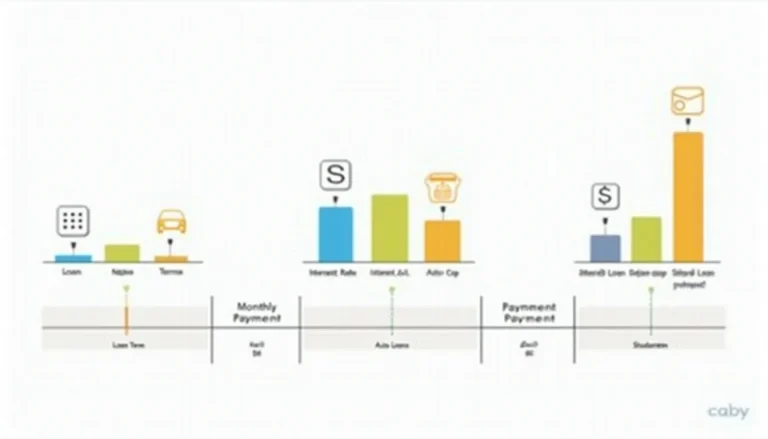

Credit management is crucial for maintaining a healthy financial position in any business. This category offers essential tools and insights for evaluating credit policies and optimizing collection practices. From calculating remaining loan balances to determining monthly installments, these resources help streamline your credit-related processes. The receivables turnover ratio calculator allows you to measure your credit collection and overall business efficiency, providing valuable metrics for decision-making. By leveraging these tools, businesses can improve cash flow, reduce bad debt risks, and enhance their overall financial performance. Explore our credit management resources to take control of your company’s financial health and drive sustainable growth.