Straight Line Method Calculator: Easily Compute Annual Asset Depreciation

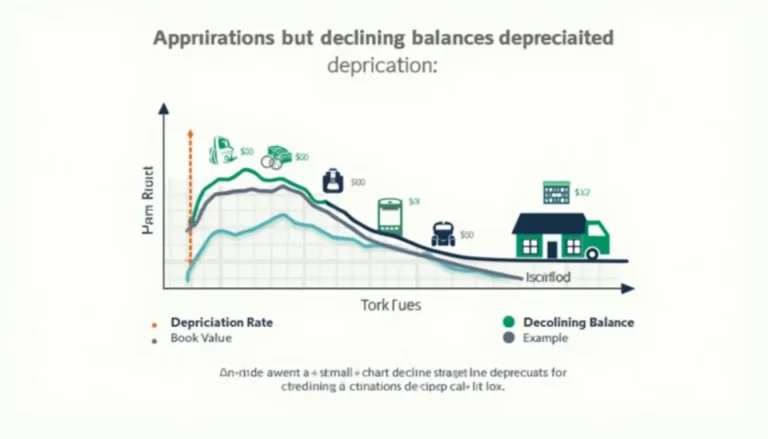

A depreciation calculator is an essential tool for businesses to accurately determine the declining value of their assets over time. This powerful resource enables users to compute asset depreciation using various methods, including the straight-line method and declining balance method. By utilizing a depreciation calculator, companies can effectively manage their financial records, make informed decisions about asset replacement, and optimize tax deductions. Whether you’re dealing with equipment, vehicles, or other business assets, this tool simplifies the complex process of calculating depreciation. Explore our depreciation calculator today to streamline your financial planning and gain valuable insights into your asset management strategy.