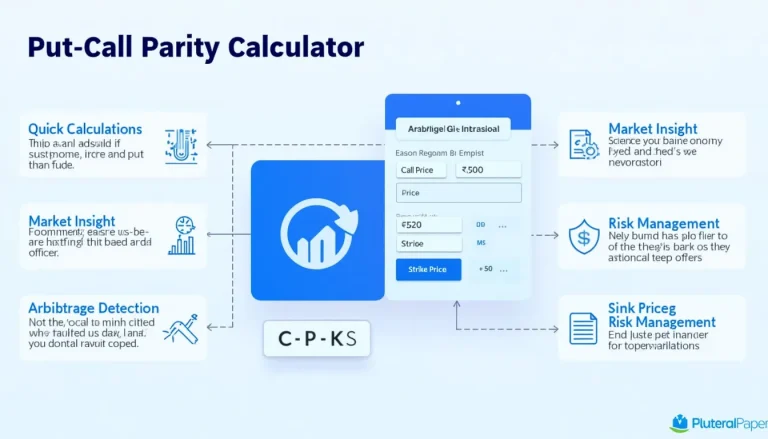

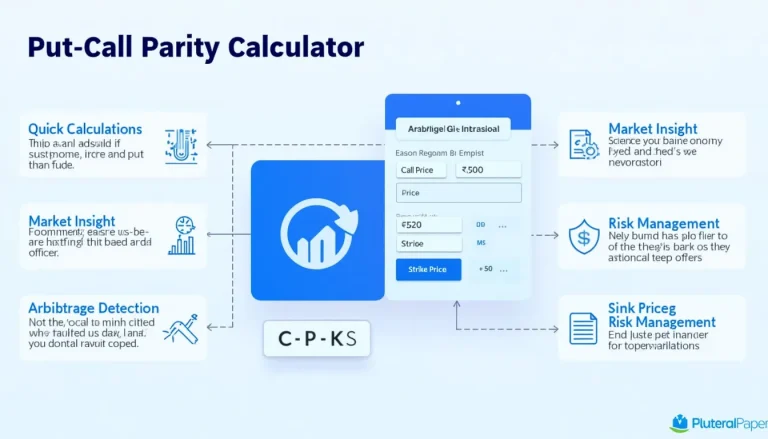

Put-Call Parity Calculator: Determine Future Price in Options Trading

Financial derivatives are sophisticated financial instruments that derive their value from underlying assets, indices, or entities. These complex tools play a crucial role in risk management, speculation, and hedging strategies for businesses and investors. Our category covers various types of derivatives, including options, futures, forwards, and swaps, providing in-depth insights into their mechanics and applications. We offer valuable resources like the Put-Call Parity Calculator, which helps traders determine future prices in options trading, enhancing decision-making processes. Whether you’re a financial professional, trader, or business owner, understanding financial derivatives can significantly impact your investment and risk management strategies. Explore our comprehensive guides and tools to leverage the power of financial derivatives in your financial operations.