Straight Line Method Calculator: Easily Compute Annual Asset Depreciation

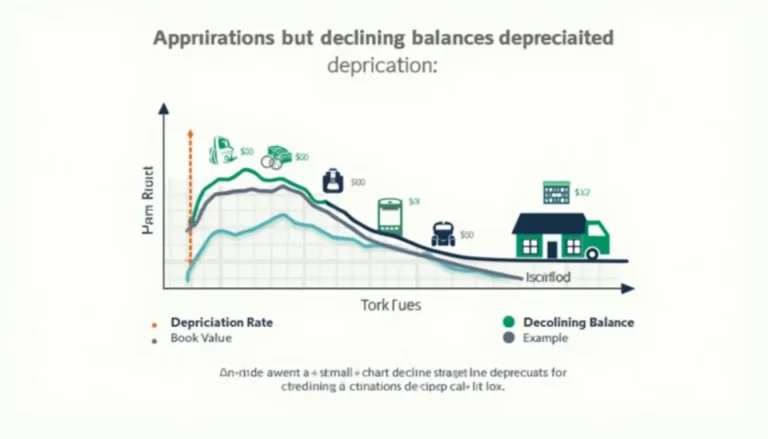

Fixed assets are crucial components of a company’s financial structure, representing long-term investments in tangible resources. This category provides essential tools and information for managing and analyzing fixed assets effectively. Users can access calculators for both straight-line and declining balance depreciation methods, enabling accurate computation of asset depreciation over time. These tools are invaluable for businesses seeking to optimize their financial planning and reporting processes. By utilizing these resources, professionals can make informed decisions about asset acquisition, maintenance, and replacement strategies. Explore our fixed assets category to enhance your company’s asset management practices and improve overall financial performance.