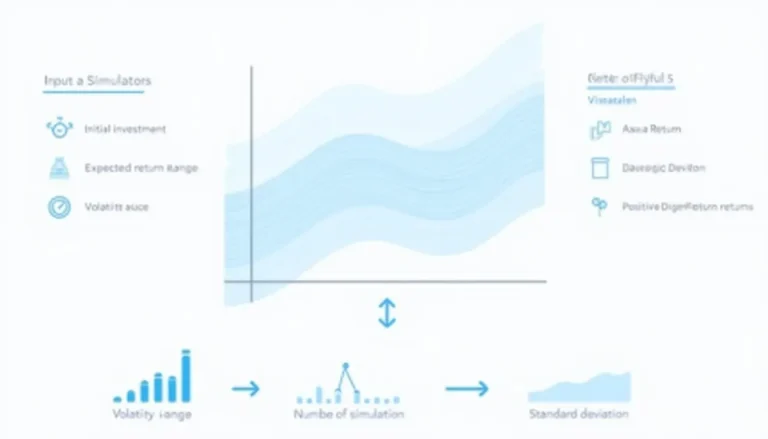

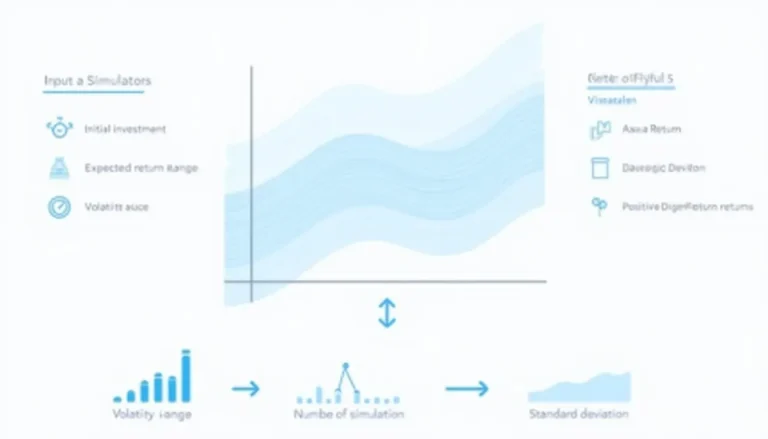

Portfolio Return Monte Carlo Simulator: Estimate Investment Outcomes

Monte Carlo simulation is a sophisticated statistical technique used to model the probability of different outcomes in complex systems. This powerful tool enables businesses and professionals to estimate potential results by running multiple trial runs, called simulations, using random variables. It’s particularly valuable in finance, where it can be used to estimate investment outcomes and portfolio returns. Monte Carlo simulations help decision-makers understand the impact of risk and uncertainty in prediction and forecasting models. By providing a range of possible outcomes and their probabilities, this method allows for better risk assessment and more informed decision-making. Whether you’re in finance, engineering, or any field dealing with uncertainty, Monte Carlo simulation can provide valuable insights to optimize your strategies and improve outcomes.