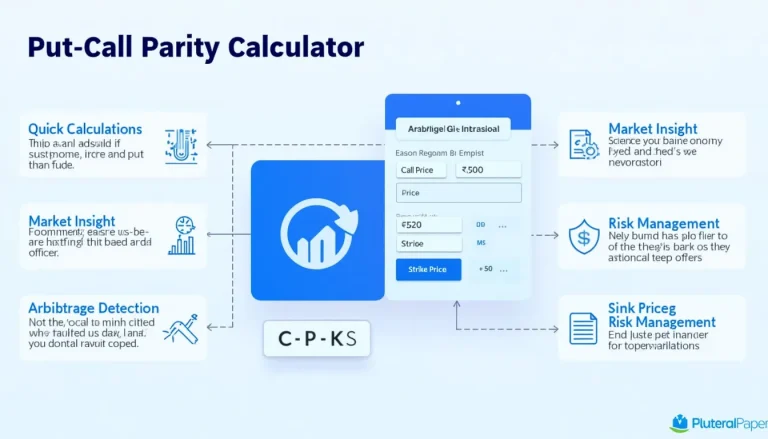

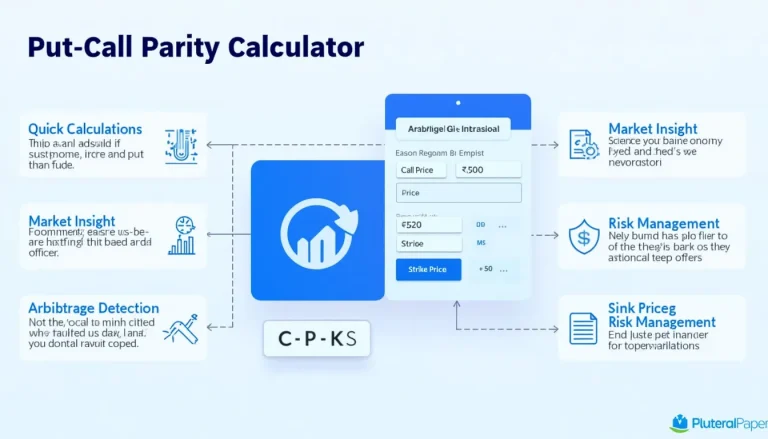

Put-Call Parity Calculator: Determine Future Price in Options Trading

Option pricing is a crucial aspect of financial markets, providing methods to accurately value options and other derivative instruments. These techniques help investors and traders determine fair market prices for options, enabling better decision-making and risk management. Option pricing models, such as the Black-Scholes model, consider factors like underlying asset price, strike price, time to expiration, volatility, and interest rates. Tools like the Put-Call Parity Calculator can assist in determining future prices in options trading, enhancing strategy development. By mastering option pricing techniques, financial professionals can improve their ability to assess market conditions, hedge risks, and optimize investment portfolios. Explore our resources to enhance your understanding of option pricing and elevate your trading strategies.