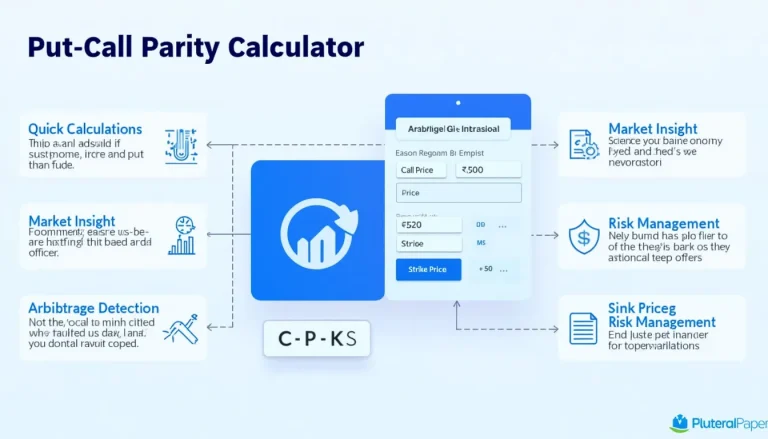

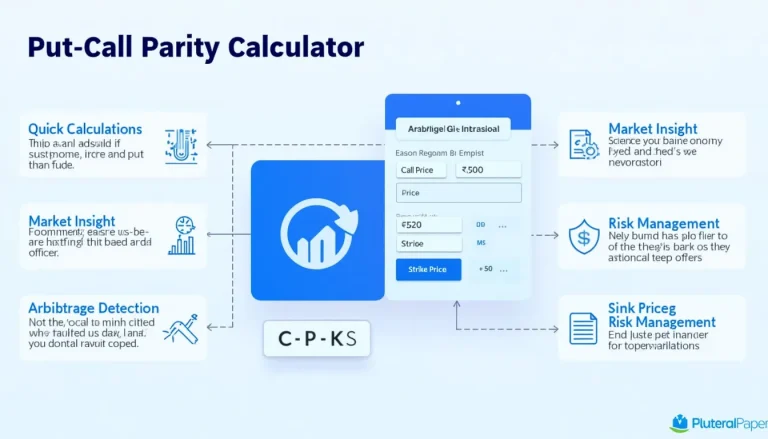

Put-Call Parity Calculator: Determine Future Price in Options Trading

Put-call parity is a fundamental principle in options pricing that establishes a relationship between the prices of put and call options. This concept is essential for traders and financial professionals to understand market equilibrium and identify potential arbitrage opportunities. By utilizing tools like the Put-Call Parity Calculator, users can accurately determine future prices in options trading, leading to more informed decision-making. This principle helps in assessing the fair value of options, detecting mispriced securities, and developing sophisticated trading strategies. Whether you’re a seasoned trader or just starting in the world of options, mastering put-call parity can significantly improve your ability to analyze and predict market movements. Explore this category to enhance your options trading knowledge and skills.