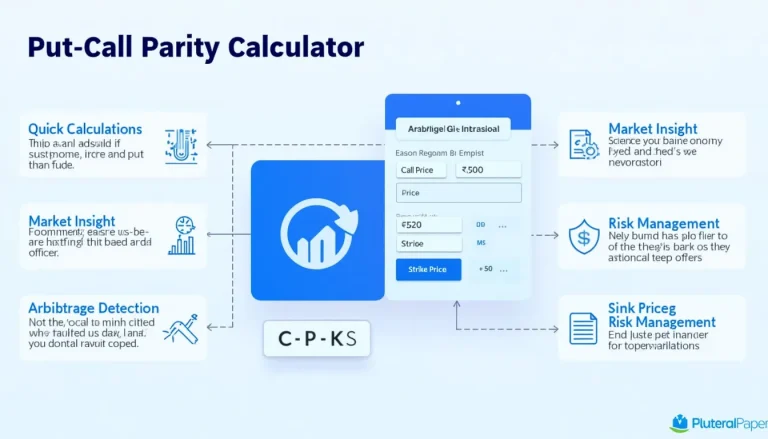

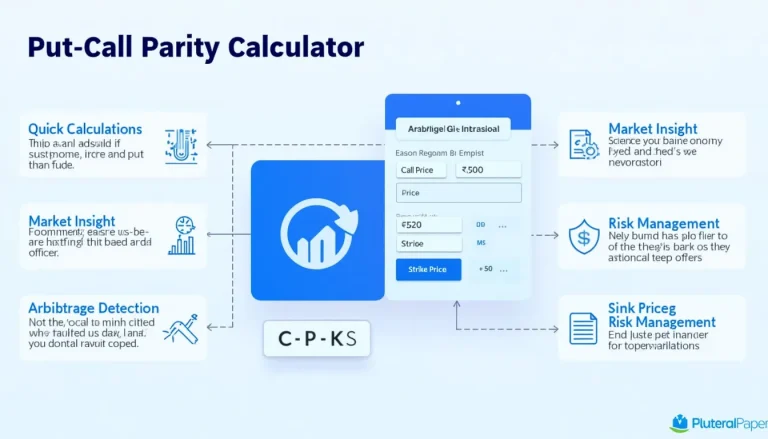

Put-Call Parity Calculator: Determine Future Price in Options Trading

Put options are financial contracts that give the holder the right, but not the obligation, to sell an underlying asset at a specified price within a set time frame. These powerful tools are essential for risk management and speculative strategies in options trading. Understanding put options is crucial for investors and traders looking to hedge against potential market downturns or profit from bearish price movements. By incorporating concepts like put-call parity, traders can determine future prices and make informed decisions. Whether you’re a seasoned professional or new to options trading, mastering put options can significantly enhance your trading toolkit and help you navigate volatile markets with confidence. Explore our resources to deepen your knowledge and improve your options trading strategies today.