Rule of 72 Calculator: Estimate Investment Doubling Time

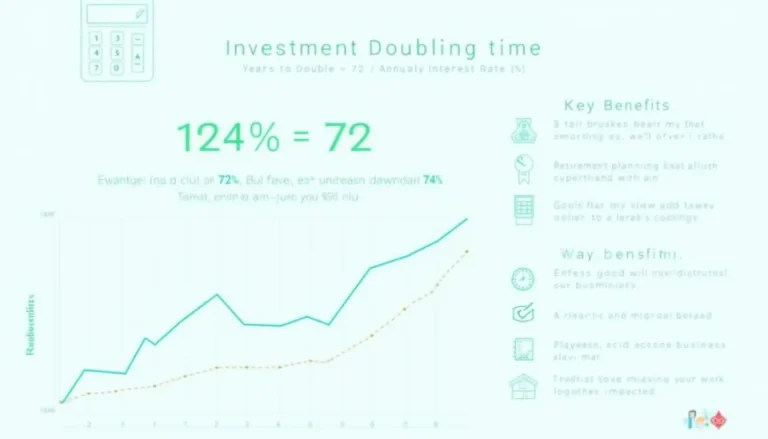

The Rule of 72 is a powerful financial concept used to estimate the time it takes for an investment to double in value. This simple formula provides quick insights into growth rates and investment potential, making it an invaluable tool for financial planning and decision-making. By dividing 72 by the annual rate of return, investors can quickly approximate the number of years required for their investment to double. Our Rule of 72 Calculator streamlines this process, allowing businesses and professionals to easily estimate investment doubling times and compare different growth scenarios. Whether you’re evaluating investment opportunities or planning long-term financial strategies, the Rule of 72 offers a practical approach to understanding compound growth. Explore our calculator today to enhance your financial analysis and make more informed investment decisions.