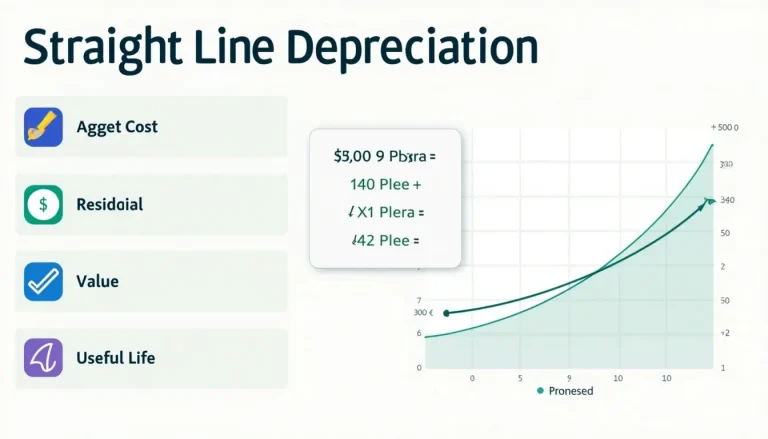

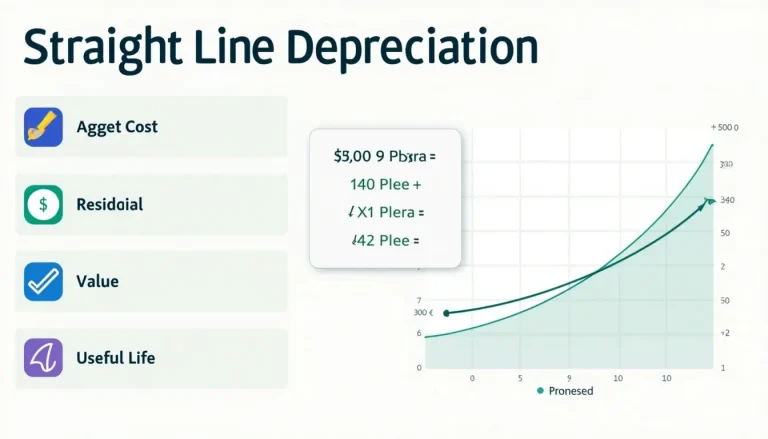

Straight Line Method Calculator: Easily Compute Annual Asset Depreciation

The Straight Line Method is a fundamental accounting technique used to calculate the depreciation of assets over time. This category provides essential information and tools for businesses to accurately determine the annual depreciation of their assets. Our Straight Line Method Calculator offers a user-friendly solution for computing asset depreciation quickly and efficiently. By utilizing this method, companies can evenly distribute the cost of an asset over its useful life, leading to more accurate financial reporting and improved budgeting. Whether you’re an accountant, financial analyst, or business owner, understanding and implementing the Straight Line Method is crucial for maintaining precise financial records. Explore our resources and calculator to streamline your depreciation calculations and enhance your financial planning processes.