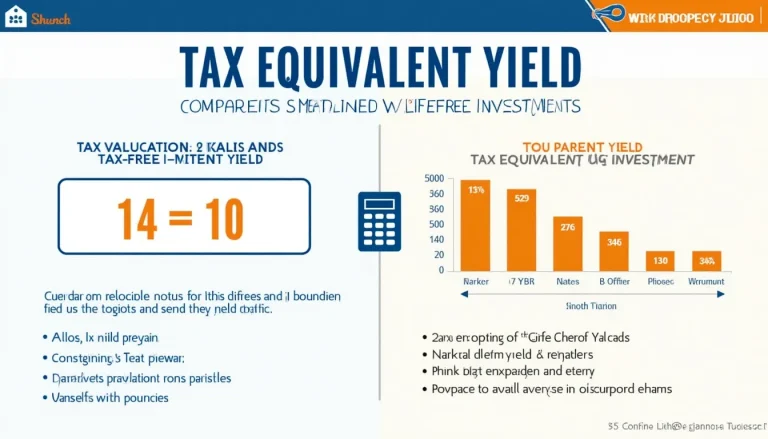

Tax Equivalent Yield Calculator: Compare Taxable and Tax-Free Investments

Tax equivalent yield is a crucial concept for investors and financial professionals seeking to compare the returns of taxable and tax-free investments. This category provides tools and information to accurately calculate tax equivalent yield, enabling users to make informed investment decisions. By using a tax equivalent yield calculator, investors can easily compare the potential returns of various investment options, taking into account their tax implications. This comparison is particularly valuable when evaluating municipal bonds against taxable alternatives. Understanding tax equivalent yield helps businesses and financial advisors optimize investment strategies, maximize returns, and minimize tax liabilities. Explore our resources to enhance your investment analysis and make more informed financial decisions.