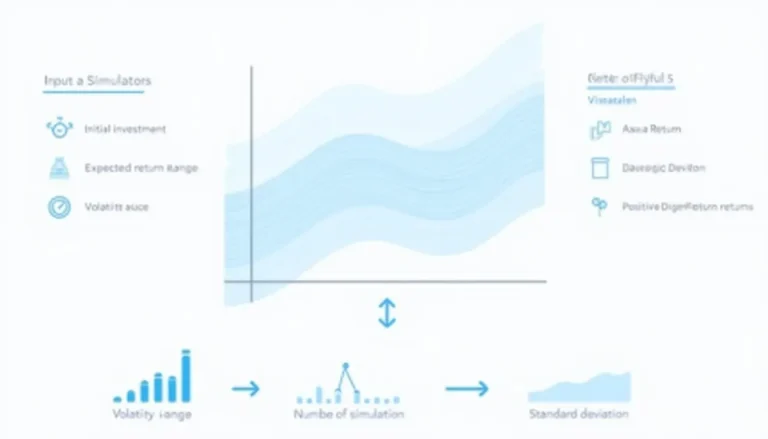

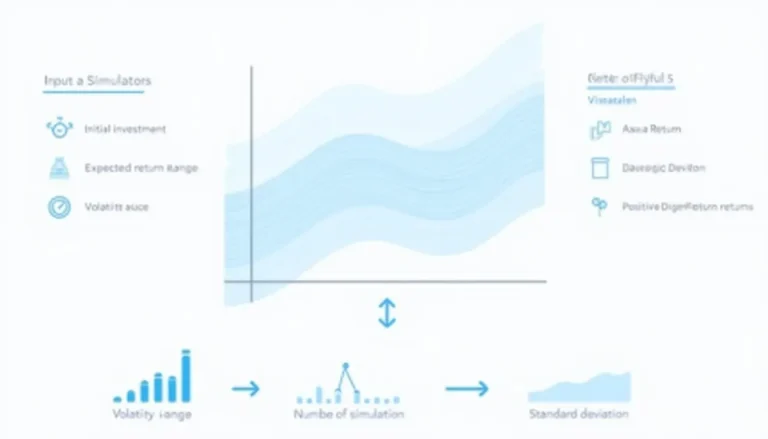

Portfolio Return Monte Carlo Simulator: Estimate Investment Outcomes

Volatility modeling is a crucial tool for analyzing and predicting price fluctuations in financial markets. This category focuses on advanced techniques to measure and forecast market volatility, enabling more accurate risk assessment and informed decision-making. By leveraging volatility models, financial professionals can develop robust investment strategies and optimize portfolio management. One key application is the use of Monte Carlo simulations to estimate investment outcomes, as seen in portfolio return simulators. These tools allow investors to assess potential scenarios and adjust their strategies accordingly. Whether you’re a trader, risk manager, or financial analyst, mastering volatility modeling can significantly enhance your ability to navigate market uncertainties. Explore this category to gain valuable insights and improve your financial forecasting capabilities.