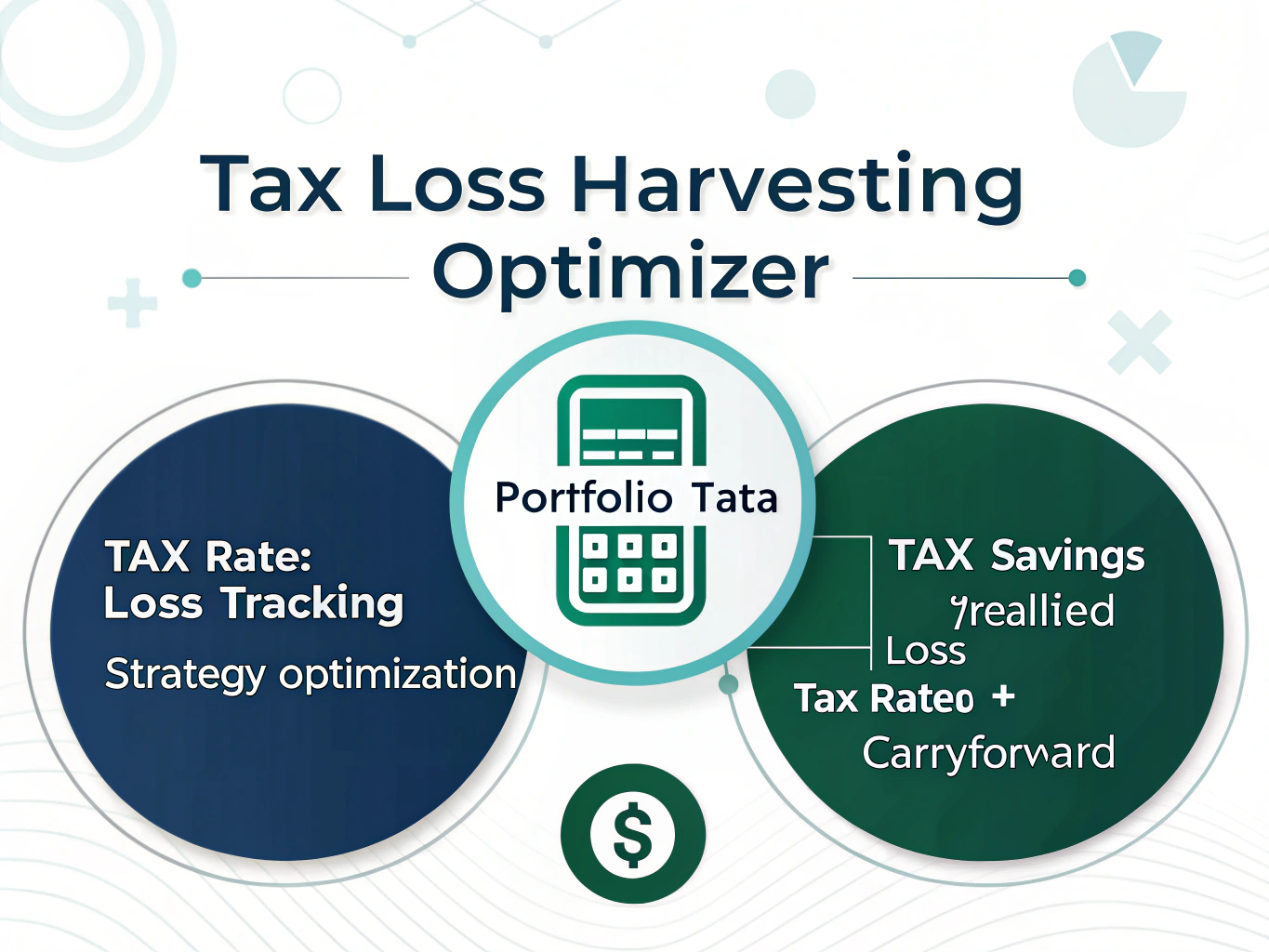

Tax Loss Harvesting Optimizer

Is this tool helpful?

How to Use the Tax Loss Harvesting Optimizer Effectively

The Tax Loss Harvesting Optimizer requires specific information to generate optimal tax-saving strategies. Here’s a detailed guide on using each field:

Portfolio Data Entry

In the first field, enter your investment details using the following format:

- Stock symbol: Purchase date, Cost basis, Current value

- Each investment should be on a new line

Example entries:

- GOOGL: Purchased 03/15/2023, Cost $2800, Current $2600

- NFLX: Purchased 06/01/2023, Cost $420, Current $380

Tax Rate Information

Enter your current marginal tax rate as a percentage. For example:

- 32 (for 32% tax bracket)

- 24 (for 24% tax bracket)

Carryforward Losses

If you have existing capital loss carryforwards, enter the dollar amount. For example:

- $7,500 from previous year’s losses

- $3,200 accumulated from past tax years

Understanding Tax Loss Harvesting

Tax loss harvesting is a sophisticated investment strategy that helps reduce your tax liability by selling investments at a loss to offset capital gains. The fundamental calculation is:

$$ \text{Tax Savings} = (\text{Realized Loss} \times \text{Marginal Tax Rate}) + \text{Carryforward Benefit} $$Core Components

- Realized Loss: The difference between purchase price and selling price

- Marginal Tax Rate: Your highest tax bracket percentage

- Carryforward Benefit: Additional tax savings from previous years’ losses

Benefits of Tax Loss Harvesting Optimization

Immediate Tax Savings

- Reduce current year tax liability

- Offset up to $3,000 of ordinary income annually

- Strategic portfolio rebalancing opportunities

Long-term Advantages

- Tax-loss carryforward benefits

- Portfolio optimization potential

- Enhanced after-tax returns

Strategic Implementation

Wash Sale Compliance

The optimizer ensures compliance with the IRS wash sale rule by:

- Tracking 30-day windows before and after sales

- Identifying substantially identical securities

- Suggesting alternative investments

Practical Example

Consider this scenario:

- Original Investment: 100 shares of XYZ at $100 ($10,000)

- Current Value: $80 per share ($8,000)

- Unrealized Loss: $2,000

- Marginal Tax Rate: 35%

Tax savings calculation:

$$ \text{Tax Savings} = \$2,000 \times 0.35 = \$700 $$Advanced Optimization Strategies

Portfolio Rebalancing Integration

- Sector allocation maintenance

- Risk profile preservation

- Market exposure continuity

Timing Considerations

- Year-end harvesting opportunities

- Market volatility exploitation

- Tax bracket optimization

Real-World Applications

Case Study 1: Market Downturn Response

During a market correction:

- Initial Portfolio: $500,000

- Realized Losses: $45,000

- Tax Rate: 32%

- Tax Savings: $14,400

Case Study 2: Portfolio Transition

Modernizing an inherited portfolio:

- Legacy Positions: $250,000

- Strategic Losses: $25,000

- Tax Rate: 24%

- Tax Savings: $6,000

Frequently Asked Questions

What is tax loss harvesting?

Tax loss harvesting is an investment strategy that involves selling securities at a loss to offset capital gains tax liability. This practice can help reduce your overall tax burden while maintaining your desired investment exposure.

How often should I harvest tax losses?

While tax loss harvesting can be done throughout the year, many investors focus on year-end opportunities. Regular monitoring of your portfolio can help identify optimal harvesting moments, especially during market volatility.

Can I harvest losses in retirement accounts?

Tax loss harvesting is only applicable to taxable investment accounts. Retirement accounts like 401(k)s and IRAs are tax-deferred or tax-exempt, making tax loss harvesting unnecessary.

How do I maintain my investment strategy while harvesting losses?

The optimizer helps maintain your investment strategy by suggesting replacement securities that provide similar market exposure while complying with wash sale rules. This ensures your portfolio remains aligned with your investment goals.

What types of losses can be harvested?

Both short-term and long-term capital losses can be harvested. Short-term losses offset short-term gains first, while long-term losses offset long-term gains. Any excess losses can offset the other type of gain or up to $3,000 of ordinary income.

How does the carryforward feature work?

If your capital losses exceed your capital gains plus $3,000 in any year, the excess can be carried forward indefinitely to future tax years. The optimizer accounts for these carryforwards in its calculations for maximum tax efficiency.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.