Trust Fund Distribution Planner

Is this tool helpful?

How to Use the Trust Fund Distribution Planner

The Trust Fund Distribution Planner tool consists of two main input fields:

- Initial Principal Amount: Enter the total trust fund amount (e.g., $2,500,000 or $750,000)

- Annual Distribution Rate: Input the desired withdrawal percentage (preset to 4% based on safe withdrawal principles)

After entering these values, click the “Calculate Distribution” button to determine your annual distribution amount.

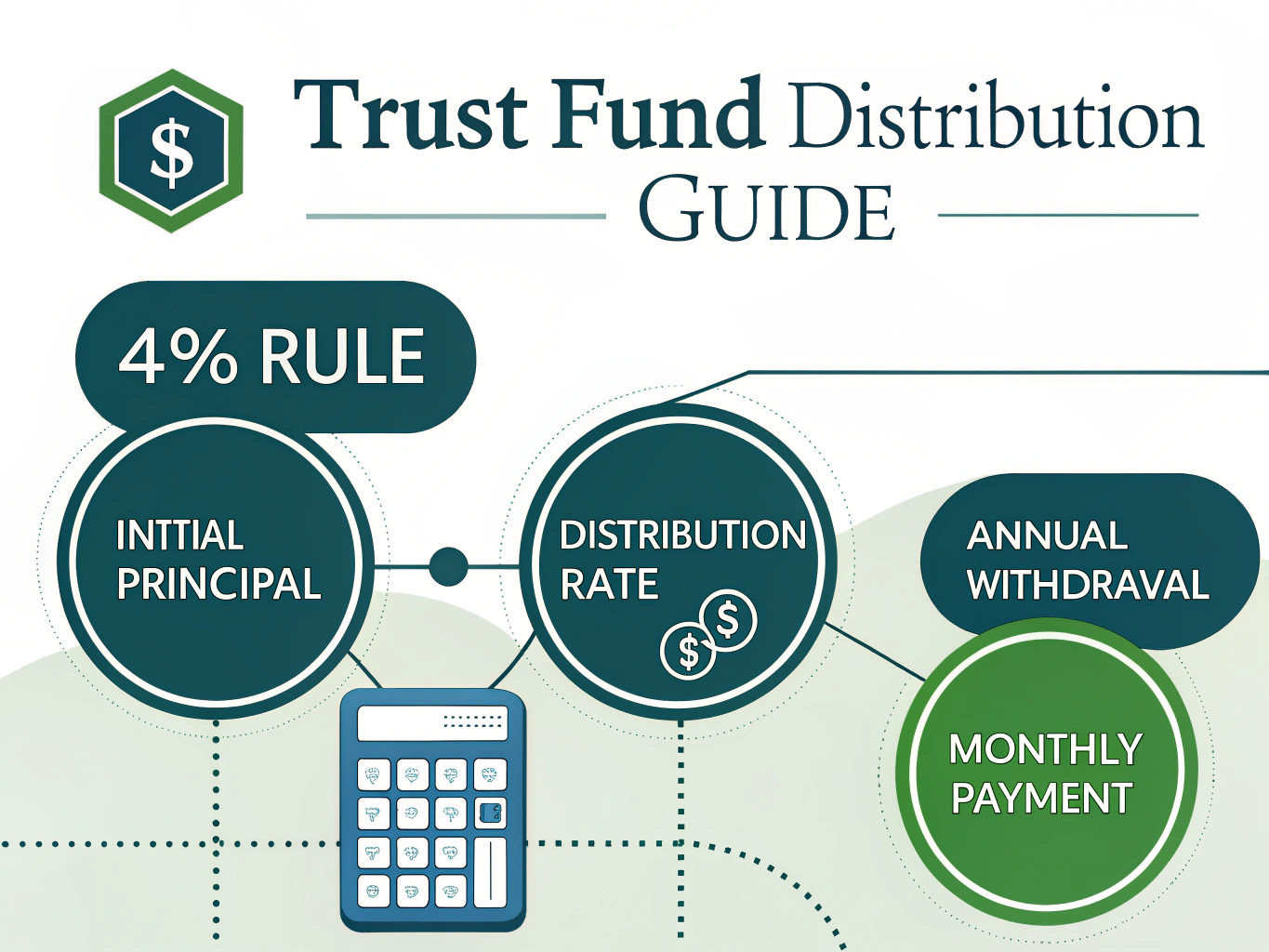

Understanding Trust Fund Distribution Planning

A trust fund distribution planner is a financial tool designed to help trustees, beneficiaries, and financial advisors calculate sustainable annual withdrawals from a trust fund while preserving the principal amount for long-term stability.

The mathematical formula for calculating the annual distribution is:

$$ \text{Annual Distribution} = \text{Principal} \times \text{Distribution Rate} $$The Significance of the 4% Rule

The default 4% distribution rate is based on extensive research in sustainable withdrawal rates, often referred to as the “4% Rule” or “Safe Withdrawal Rate.” This rate is designed to provide a balance between:

- Generating meaningful annual income

- Protecting against inflation

- Maintaining the fund’s long-term viability

- Preserving purchasing power across generations

Benefits of Using the Trust Fund Distribution Planner

1. Strategic Financial Planning

- Helps establish sustainable withdrawal strategies

- Facilitates long-term financial planning

- Enables informed decision-making about distribution amounts

2. Risk Management

- Prevents excessive withdrawals that could deplete the principal

- Maintains fund longevity through controlled distribution

- Balances current needs with future sustainability

3. Enhanced Communication

- Provides clear distribution expectations for beneficiaries

- Facilitates discussions between trustees and financial advisors

- Helps explain distribution decisions to stakeholders

Practical Applications and Examples

Example 1: Large Family Trust

Consider a family trust with a principal amount of $3,500,000:

- Principal: $3,500,000

- Distribution Rate: 4%

- Annual Distribution: $140,000

Example 2: Educational Trust Fund

For an educational trust established with $850,000:

- Principal: $850,000

- Distribution Rate: 4%

- Annual Distribution: $34,000

Strategic Implementation Guidelines

Distribution Timing Options

- Annual distributions: $140,000 once per year

- Semi-annual distributions: $70,000 twice per year

- Quarterly distributions: $35,000 four times per year

- Monthly distributions: $11,666.67 twelve times per year

Long-term Planning Considerations

- Market condition adjustments

- Inflation impact assessment

- Tax implications management

- Estate planning integration

Frequently Asked Questions

Why is 4% considered a safe withdrawal rate?

The 4% rate is based on historical market performance studies showing that this withdrawal rate typically allows the principal to maintain its value while providing sustainable income over extended periods.

Can I adjust the distribution rate?

Yes, the tool allows for customized distribution rates based on specific trust requirements, market conditions, or beneficiary needs.

How often should distribution calculations be reviewed?

It’s recommended to review distribution calculations annually or when significant changes occur in market conditions or beneficiary circumstances.

Are distributions automatically adjusted for inflation?

The basic calculation doesn’t include automatic inflation adjustments. Trustees should periodically review and adjust distribution amounts to maintain purchasing power.

Can this tool be used for different types of trusts?

Yes, this calculator is versatile and can be applied to various trust types, including family trusts, educational trusts, charitable trusts, and generation-skipping trusts.

Best Practices for Trust Fund Distribution

Regular Review Schedule

- Annual performance assessment

- Quarterly distribution monitoring

- Periodic beneficiary needs evaluation

Documentation Requirements

- Distribution calculation records

- Rate adjustment justifications

- Beneficiary communication logs

Professional Collaboration

While this tool provides valuable calculations, optimal trust fund management often involves collaboration with:

- Financial advisors

- Tax professionals

- Estate planning attorneys

- Trust administrators

Additional Considerations

- State-specific trust regulations

- Tax efficiency strategies

- Investment portfolio diversification

- Beneficiary communication protocols

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.