Pricing Strategy Generator

Is this tool helpful?

How to Use the Value-Based Pricing Calculator Effectively

Follow these steps to get the most accurate and useful pricing recommendations from the Value-Based Pricing Calculator:

-

Describe Your Product: Provide a clear description of your product’s unique features and benefits. Examples include:

- “A solar-powered portable charger compatible with all USB devices, offering fast charging with eco-friendly materials.”

- “A premium ergonomic office chair with adjustable lumbar support, breathable mesh fabric, and integrated heating and massage functions.”

-

Define Your Target Audience: Share details about your ideal customers, their needs, and behaviors. For example:

- “Freelancers and remote workers aged 25-45 who prioritize comfort and ergonomic design in home office setups.”

- “Eco-conscious outdoor enthusiasts aged 20-40 looking for sustainable and durable charging solutions.”

-

Analyze Competitors: Provide information on your competitors’ products, prices, and market positioning. For instance:

- “Competitor Z offers portable chargers at $50, but their products lack fast charging and eco-focused features.”

- “Competitor Y sells ergonomic chairs starting at $200, but with limited adjustability and no heating options.”

-

Include Market Research Insights: Share relevant trends, consumer preferences, or economic factors shaping your industry. Examples:

- “Increasing demand for sustainable products, growing remote work culture, and rising awareness of ergonomic health.”

- “Technology adoption trends showing preference for fast charging, and consumers willing to invest in premium comfort products.”

- Assess Price Sensitivity: Evaluate how much your target market might react to price changes, considering if your customers are price-sensitive or value-driven.

- Explain Psychological Pricing Strategies: Describe psychological pricing approaches you may use, such as pricing just below round numbers or offering limited-time discounts.

- Generate Pricing Strategy: Click “Generate Pricing Strategy” to receive a tailored pricing recommendation based on all provided inputs.

What Is the Value-Based Pricing Calculator and Why Use It?

The Value-Based Pricing Calculator helps you create a pricing strategy centered on the actual value your product delivers to customers, instead of just production costs or competitor prices. This tool uses your inputs about your product, target market, competitors, and market trends to give you a customized pricing recommendation that maximizes revenue and market fit.

By focusing on customer-perceived value, this calculator enables you to price your new product strategically, aligning your price with what your customers are willing to pay. This leads to better profit margins, stronger market positioning, and more informed product decisions.

Key Benefits of Using This Calculator

- Maximize your revenue by setting prices that reflect true customer value rather than just costs.

- Position your product effectively within a competitive marketplace based on unique value propositions.

- Understand customer needs better, promoting a more customer-centric business approach.

- Adapt pricing dynamically as market conditions and customer perceptions evolve.

- Avoid the dangers of commoditization by emphasizing the distinct value of your offering.

- Gain useful insights that can guide future product development and marketing strategies.

Practical Applications of the Value-Based Pricing Calculator

This calculator supports businesses in diverse industries by delivering tailored pricing plans that reflect real customer value. Here are two practical examples of its application:

Example 1: Smart Home Security Camera Launch

- Product Description: “Compact smart security camera with 1080p HD video, night vision, motion detection, and smartphone alerts.”

- Target Audience: “Homeowners aged 30-50 who prioritize affordable security solutions with easy integration.”

- Competitor Info: “Competitor A prices similar cameras at $150 with fewer features. Competitor B offers budget models at $100 but without smartphone connectivity.”

- Market Trends: “Growing concerns about home safety and rising adoption of smart home devices.”

The calculator could recommend pricing around $140 to emphasize enhanced features while staying competitive.

Example 2: Eco-Friendly Fitness Apparel Line

- Product Description: “Sustainable activewear made from recycled materials, moisture-wicking, and biodegradable packaging.”

- Target Audience: “Fitness enthusiasts aged 20-35 who value environmentally conscious products.”

- Competitor Info: “Competitor C’s eco-line is priced at $60 per piece; Competitor D offers non-sustainable alternatives at $40.”

- Market Trends: “Increasing demand for green products and rising social responsibility awareness.”

The tool might suggest a price point near $65 to reflect sustainability benefits and position the brand as a premium choice.

Understanding the Mathematics Behind Value-Based Pricing

The Value-Based Pricing Calculator bases recommendations on key economic concepts that emphasize customer value and demand responsiveness.

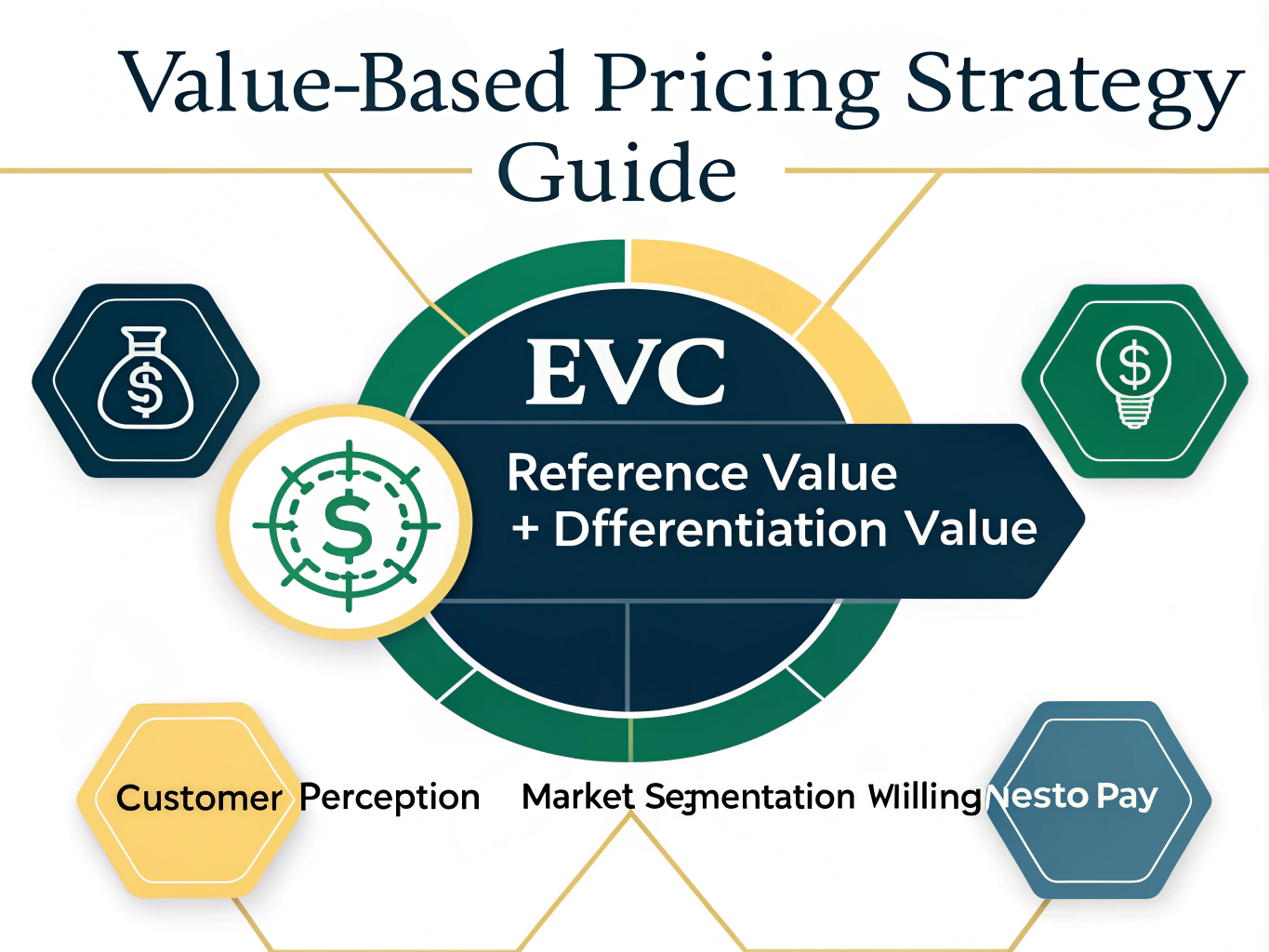

Economic Value to the Customer (EVC)

EVC quantifies the total value your product delivers relative to alternatives:

$$ EVC = Reference \ Value + Differentiation \ Value $$- Reference Value: The price of the customer’s best current alternative.

- Differentiation Value: The additional benefits and unique features your product offers.

Price Elasticity of Demand

Understanding how sensitive customers are to price changes helps set optimal prices:

$$ Price \ Elasticity = \frac{\% \ Change \ in \ Quantity \ Demanded}{\% \ Change \ in \ Price} $$High elasticity means small price changes cause big shifts in demand, so prices must be set carefully.

Value-Based Pricing Index

This index compares perceived value to production costs:

$$ Value \ Based \ Pricing \ Index = \frac{Perceived \ Customer \ Value}{Cost \ to \ Produce} $$A higher index indicates greater potential to price your product at a premium, capturing more customer value.

Frequently Asked Questions About Value-Based Pricing

1. How does value-based pricing differ from cost-plus pricing?

Value-based pricing sets your price based on what customers perceive as valuable, not just your costs. Cost-plus pricing adds a markup to production cost, but value-based pricing aligns price with customer benefit, often improving profitability.

2. Is value-based pricing suitable for every product?

It works best for products with clear unique features or strong differentiation. For commoditized products where customers see little difference, purely value-based pricing is harder to apply.

3. How can I factor in market trends with this calculator?

You can add recent market trends or consumer behavior changes to reflect the broader context, helping the calculator generate pricing aligned with current demand and industry dynamics.

4. Can this tool help with psychological pricing strategies?

Yes, by asking you to describe intended psychological pricing tactics, the calculator can tailor your strategy to include techniques like charm pricing or anchoring, improving customer appeal.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.