Venture Capital ROI Projector

Is this tool helpful?

How to Use the Venture Capital ROI Projector Effectively

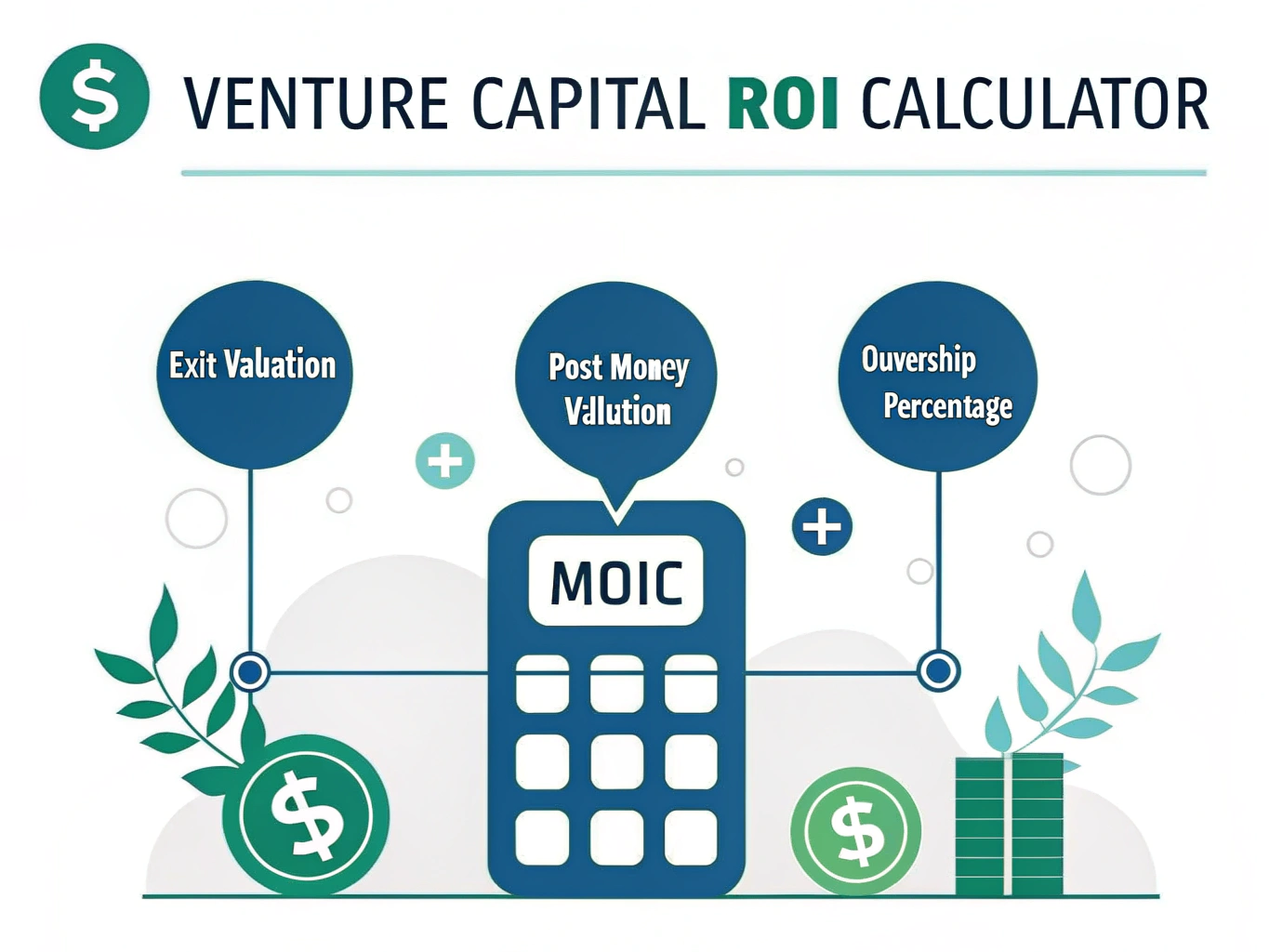

The Venture Capital ROI Projector calculates the Multiple on Invested Capital (MOIC) by following these simple steps:

- Exit Valuation ($): Enter the projected exit value of the company. For example, if you expect the company to be worth $50 million at exit, input 50000000.

- Post-Money Valuation ($): Input the company’s valuation after investment. For instance, if the company is valued at $10 million post-investment, enter 10000000.

- Ownership Percentage (%): Enter your equity stake as a percentage. If you own 25% of the company, input 25.

The calculator will then display your MOIC as a multiple (e.g., 2.5x), indicating the return on your investment.

Understanding the Venture Capital ROI Projector

The Venture Capital ROI Projector is an essential tool for venture capitalists, angel investors, and startup founders to estimate potential returns on their investments. It calculates the Multiple on Invested Capital (MOIC), a crucial metric in venture capital that measures the gross return on investment before fees and carrying costs.

The mathematical formula for MOIC is:

$$ MOIC = \frac{Exit\;Valuation}{Post-Money\;Valuation} \times Ownership\;Percentage $$Core Components of MOIC Calculation

- Exit Valuation: The expected value of the company at the time of exit (IPO, acquisition, or secondary sale)

- Post-Money Valuation: The company’s value immediately after investment

- Ownership Percentage: The investor’s equity stake in the company

Benefits of Using the Venture Capital ROI Projector

1. Investment Decision Making

- Quick assessment of potential investment returns

- Comparison of different investment opportunities

- Portfolio planning and optimization

2. Stakeholder Communication

- Clear presentation of expected returns to limited partners

- Alignment of expectations with founders

- Simplified reporting to investment committees

3. Risk Assessment

- Evaluation of required exit values for target returns

- Scenario planning with different exit multiples

- Assessment of dilution impact on returns

Practical Applications and Problem Solving

Example 1: Early-Stage Investment

Consider investing $2 million for a 20% stake in a company at a $10 million post-money valuation. If the projected exit value is $100 million, the MOIC calculation would be:

$$ MOIC = \frac{100,000,000}{10,000,000} \times 0.20 = 2.0x $$Example 2: Growth Stage Investment

For a $5 million investment securing 15% ownership at a $33.3 million post-money valuation, with a projected exit of $200 million:

$$ MOIC = \frac{200,000,000}{33,300,000} \times 0.15 = 0.90x $$Real-World Use Cases

1. Portfolio Management

Venture capital firms use the MOIC calculator to:

- Balance portfolio risk and return expectations

- Set investment thresholds for different stages

- Track performance across investments

2. Fundraising

Startups utilize the calculator to:

- Demonstrate potential returns to investors

- Justify valuation requests

- Model different investment scenarios

3. Exit Planning

Both investors and founders use it to:

- Plan optimal exit timing

- Set valuation targets

- Negotiate acquisition terms

Frequently Asked Questions

What is a good MOIC for venture capital investments?

While target MOICs vary by investment stage and strategy, early-stage venture capital investments typically target 10x or higher, while later-stage investments might target 3-5x returns.

How does MOIC differ from IRR?

MOIC measures the total return multiple regardless of time, while Internal Rate of Return (IRR) accounts for the time value of money. Both metrics are important for comprehensive investment analysis.

Should I consider dilution in MOIC calculations?

Yes, future dilution from additional funding rounds should be considered when projecting MOIC. The calculator can be used with different ownership percentages to model dilution scenarios.

Can MOIC be used for comparing investments?

Yes, MOIC is useful for comparing investments, but should be used alongside other metrics like IRR and risk assessment for comprehensive evaluation.

How often should I update MOIC projections?

MOIC projections should be updated regularly, particularly after significant company events, new funding rounds, or changes in market conditions that might affect exit valuations.

What factors influence exit valuations?

Exit valuations are influenced by market conditions, company performance, industry multiples, strategic value to acquirers, and overall economic conditions.

Advanced Usage Tips

Scenario Analysis

Use the calculator to model multiple scenarios:

- Conservative case: Lower exit valuations

- Base case: Expected market conditions

- Optimistic case: Strong market performance

Portfolio Planning

Implement the calculator for:

- Setting investment size based on return targets

- Balancing early and late-stage investments

- Determining follow-on investment strategies

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors. By using our tools, you acknowledge that you have read, understood, and agreed to this disclaimer. You accept the inherent risks and limitations associated with the use of our tools and services.