Yield to Maturity Calculator

Is this tool helpful?

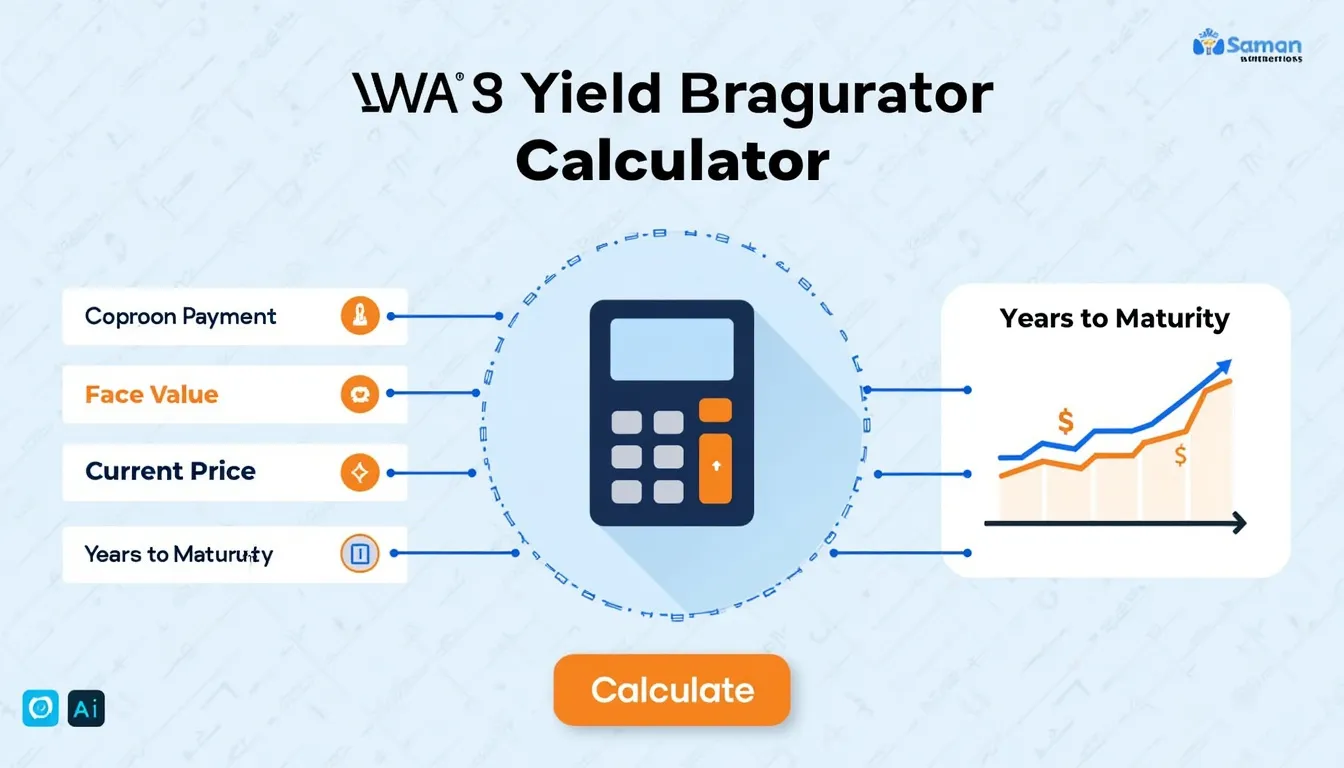

How to use the tool

- Coupon/Interest Payment ($): Type the yearly coupon. Example A: $45; Example B: $0.

- Face Value ($): Enter the amount repaid at maturity. Example A: $1,000; Example B: $5,000.

- Current Price ($): Insert the bond’s present market price. Example A: $950; Example B: $4,300.

- Years to Maturity: Provide time until repayment. Example A: 8 years; Example B: 6 years.

- Press “Calculate YTM” to view the approximate annual yield.

Formula used

The tool applies the standard approximation:

$$ YTM rac{C+\frac{F-P}{n}}{\frac{F+P}{2}} $$- C = annual coupon payment

- F = face value

- P = current price

- n = years to maturity

Example calculations

- Example A: $$YTM rac{45+\frac{1000-950}{8}}{\frac{1000+950}{2}} rac{51.25}{975}=0.0526\ (5.26\%)$$

- Example B (zero-coupon): $$YTM rac{0+\frac{5000-4300}{6}}{\frac{5000+4300}{2}} rac{116.67}{4650}=0.0251\ (2.51\%)$$

Quick-Facts

- Average 10-year U.S. Treasury yield in June 2024: 4.25 % (U.S. Treasury, 2024).

- Corporate bonds settle in $1,000 face-value lots (FINRA, 2024).

- Most U.S. corporates pay coupons semi-annually (Fabozzi, 2021).

- Price-yield sensitivity: a 1 % rate rise cuts a 10-year 5 % bond about 8 % (Fabozzi, 2021).

FAQ

What is yield to maturity?

Yield to maturity is the internal rate of return earned if you hold the bond until it repays principal and coupons (Fabozzi, 2021).

Why use this calculator instead of current yield?

Current yield ignores capital gain or loss at maturity; YTM includes both, giving a fuller return picture (Investopedia, 2024).

Which inputs are mandatory?

You need coupon payment, face value, current market price and years to maturity; omit nothing for accuracy.

Can the tool handle zero-coupon bonds?

Yes—enter 0 for the coupon, and YTM becomes the bond’s implied discount rate.

How precise is the approximation?

It’s within 0.1-0.3 percentage points for bonds near par and maturities under 15 years (Fabozzi, 2021).

Does YTM include default risk?

YTM assumes full payment; it excludes default probability, so assess credit ratings separately (Moody’s, 2023).

How does YTM help compare bonds?

YTM places bonds of different coupons and maturities on one scale, letting you spot higher risk-adjusted returns (IMF, 2022).

How often should I recalculate?

Recheck YTM after major price moves or rate changes; active traders update daily, long-term holders quarterly.

Important Disclaimer

The calculations, results, and content provided by our tools are not guaranteed to be accurate, complete, or reliable. Users are responsible for verifying and interpreting the results. Our content and tools may contain errors, biases, or inconsistencies. Do not enter personal data, sensitive information, or personally identifiable information in our web forms or tools. Such data entry violates our terms of service and may result in unauthorized disclosure to third parties. We reserve the right to save inputs and outputs from our tools for the purposes of error debugging, bias identification, and performance improvement. External companies providing AI models used in our tools may also save and process data in accordance with their own policies. By using our tools, you consent to this data collection and processing. We reserve the right to limit the usage of our tools based on current usability factors.